Trust accounts are established to hold the funds of another entity or an individual on the behalf of that entity. The person who manages the trust account is called trustee. For creating a trust account one should consult a lawyer or financial adviser to get right information according to their specific situation.

Reasons To Set Up Trust Accounts

Some types of trust give you a tax advantage. For e.g. the trustee relinquishes the right to the funds then he can avail a tax break. But one must consult a tax professional before taking any such step as the specification of the tax law can get very complicated in relation to trust accounts. It is also necessary to ensure that their tax professional has an experience of dealing with trusts accounts represented on tax filings.

Trust Fund Concerns

Client Trust Funds

Not any fund can be deposited to the client’s trust funds. It is very important to ensure that deposit into the client trust funds is limited to few selected funds. Funds associated with real estate, personal injury, judgment and settlements, and unearned retainer can go to the client’s trust. Funds that attorneys try to deposit in trust fund mistakenly include earned income, personal capital and payroll funds.

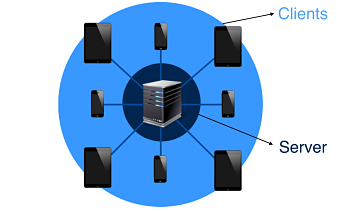

Maintaining Multiple Clients’ Funds

Usually, a single trust account held by the firm keeps the funds from multiple clients. To maintain all of these funds in a single account you must know each client’s balance and should be able to create a client transaction report which demonstrates all the activities associated with client’s fund.

Try to maintain your client’s balance in positive figures as you cannot utilize another client’s balance to cover the funds of the client who has reached a negative balance. If it happens then you have to use personal funds to cover a negative balance and it would result in forfeits of your firm during an audit.

For Easy and best software solution check out our complete Accounting and Reports Module in ERP.Gold