“The balance sheet is a snapshot of the company financial standing at an instant in time”

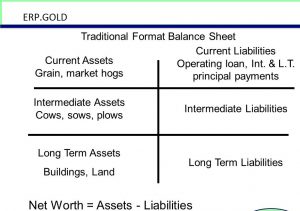

Do you know what are the Parts of a Balance Sheet? The Balance Sheet can be broadly broken into two sections, namely “Assets” and “Liabilities”. Assets are what a business uses to operate its business, while its liabilities and equity are two sources that support these assets.

The first step in understanding a transaction is to recognize whether the transaction is in relation to revenue or expense or is capital in nature. Only transactions of capital nature are reflected in Balance Sheet. For Example, any advances received from the third party will be shown on the assets side of the Balance Sheet and not as an income in the income statement, as it is capital receipt in nature.

Parts of a Balance Sheet – Categories

Fixed Assets:

These include tangible assets like buildings, machinery, furniture, or intangible assets like Patents, Trademarks, and Goodwill. It shows all the assets that are present with the business to provide with long-term benefits and are not expected to liquefy before a year.

Investments:

Investments currently present in external entities made by the business.

Current Assets, Loans, and Advances & Miscellaneous Expenditure:

Those assets which can be converted into cash within one year like Bills Receivables, Cash in hand, Bank Balance, Advances made to Creditors, dues from Debtors, Stock-in-trade, etc. It helps in determining the liquidity of the concern and its ability to pay back short-term liabilities.

Miscellaneous Expenditure includes Deferred Revenue Expenses, like advertisement expenditure, underwriting commission, share issue expenses etc which are written-off proportionately over a period of time. It is important to stress here that startups and small businesses should need to incorporate all the pre-incorporation and other startup expenses under this head.

Share Capital:

This head is popularly known as owner’s source of funds as it highlights the basis of funding of the business.

Reserves and Surplus:

It includes the retained and plowback earnings of the business that it earns from internal operations. High Reserves and Surplus indicate internal efficiency of business

Loans and Current Liabilities:

These include classification of loans into Secured and Unsecured Loans. For example, Bank Loans, Debentures, etc. These are long-term in nature (May last for at least more than a year)

Current Liabilities are similar to Current Assets; it includes those liabilities which are due to be cleared within a year’s time, like Bank overdrafts, Bills Payables, Advances from debtors and dues to Creditors.

For an automatic balance sheet software solution check out our complete Accounting and Reports Module in ERP.Gold